Turning 65

The year you turn 65 is a critical time for Medicare decision making.

Here at Review Medicare Benefits, we are your partner when you turn 65 and beyond.

What Seniors Need to Know About Turning 65

Turning 65 is a significant milestone. One of the most important aspects of this age is becoming eligible for Medicare, the federal health insurance program. It’s essential to understand your options, deadlines, and available resources. Below, we’ll walk through what to expect and how to navigate this stage.

Medicare Basics: What is it?

Medicare is a federal health insurance program primarily for individuals aged 65 and older. It also covers some younger individuals with disabilities and those with End-Stage Renal Disease (ESRD).

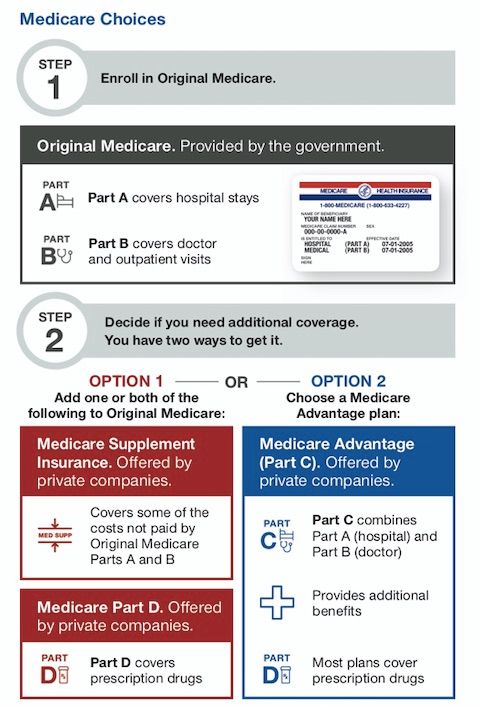

Medicare is divided into several parts:

- Medicare Part A (Hospital)

- Medicare Part B (Medical)

- Medicare Advantage (Also called Medicare Part C)

- Medicare Part D (Drug Coverage)

How to Choose the Right Medicare Plan

Finding the right coverage is critical, and that’s where we can help. Working with a knowledgeable Medicare insurance agent provides you with the best opportunity to find the right plan for you and your family. For more information, read below to get a high-level overview of the differences and what each plan type offers.

Medicare Part A (Hospital)

Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services.

Medicare Part B (Medical)

Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

Medicare Advantage

Also called Medicare Part C, these plans combine the benefits of Original Medicare (Part A and Part B) into a single plan with additional coverage, like dental, vision, hearing, wellness, and more.

Medicare Part D (Drug Coverage)

Medicare Part D Prescription Drug Plans (PDP) work in tandem with Original Medicare (Part A and Part B) and Medicare Advantage plans to provide prescription drug coverage.

Original Medicare vs. Medicare Advantage

- Original Medicare (Parts A and B): Offers nationwide coverage but does not include additional benefits like dental or vision. Beneficiaries often purchase supplemental Medigap policies to cover out-of-pocket costs.

- Medicare Advantage (Part C): Offers an all-in-one plan through private insurers, often including additional benefits and lower out-of-pocket costs, but with more restricted provider networks.

Medigap vs. Medicare Advantage

- Medigap supplements Original Medicare, while Medicare Advantage plans are an alternative to it.

- Medicare Advantage plans often include additional benefits such as vision, dental, and wellness programs, but they usually require using in-network providers.

- Medigap plans work alongside Original Medicare, allowing you to see any Medicare-approved provider and offering more predictable costs.

Long-Term Care

Medicare does not cover most long-term care services, such as nursing homes or personal care. If this is a concern, consider exploring other insurance options.

Wherever you are in the process, understanding your "two options" is the most important pieces of the Medicare puzzle.

This is your biggest decision you have to make!

Download this form to learn more.

Key Dates & Deadlines for Medicare

Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) is a seven-month window around your 65th birthday:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after your birthday month

During this time, you can:

- Enroll in Medicare Parts A and B

- Choose a Medicare Advantage Plan

- Sign up for a Part D Prescription Drug Plan

Automatic Enrollment

If you already receive Social Security or Railroad Retirement Board (RRB) benefits, you’ll likely be automatically enrolled in Medicare Parts A and B. You’ll receive your Medicare card in the mail about three months before your 65th birthday.

If you’re not receiving these benefits, you must sign up for Medicare through the Social Security Administration.

Special Enrollment Period (SEP)

If you’re still working and have health coverage through your employer or union, you may qualify for a Special Enrollment Period (SEP) to sign up for Medicare without a late enrollment penalty after your Initial Enrollment Period ends. The SEP typically lasts for eight months after your employment or group coverage ends.

Annual Enrollment Period (AEP)

Every year from October 15th to December 7th, you can add or make changes to your Medicare coverage, including:

- Enroll in, switch, or drop Medicare Advantage plans

- Enroll in, switch, or drop Medicare Part D prescription drug plans

Open Enrollment Period for Medicare Advantage Plans (OEP)

If you're enrolled in a Medicare Advantage plan, you can switch to a different plan or return to Original Medicare from January 1st to March 31st each year.

Late Enrollment Penalties for Medicare

There are a couple of late enrollment penalties to know. These occur when you do not sign up for Medicare during your IEP:

- Part B Penalty: A 10% increase in premiums for each 12-month period you were eligible but didn’t enroll.

- Part D Penalty: 1% of the national base premium for every month you were without prescription drug coverage when eligible.